London, Thursday 8 June 2023. Across the sector, CTVs are an integral part of wind farm logistics and are essential for transporting personnel and cargo to and from offshore wind farms. Although the vessels themselves are relatively small in size, a shortage of crew transfer vessels (CTVs) would have a big impact on the growing offshore wind industry.

CSO Shipbrokers, a chartering, sale and purchase, and market intelligence brokerage, specialising in offshore renewables, analyses the current trends and availability in Europe’s CTV Market.

Growth of the wind industry

The offshore wind energy industry is growing rapidly. According to Polaris Market Research, the global offshore wind energy market size is expected to register a CAGR of 12.1% growth. Industry revenue is projected to grow from $33.53 billion in 2021 to $89.76 billion by 2030.

The major drivers of this growth are increasing demand for clean energy, technological advancement in wind turbine design and installation, and government policies and initiatives on carbon emission reduction.

Trends in the CTV market

As the renewable energy market has grown, the CTV market has experienced growth too. From humble beginnings, when UK wind farms utilised repurposed fishing vessels to transfer crew in the 1990s and early 2000s, to today’s range of ‘green’ CTVs, onboard comfort, safety and efficiency have vastly improved in the last three decades.

CTVs: is bigger actually better?

As wind farms increase in size and distance from shore, demand is rising for vessels with larger capacity to transfer personnel and equipment.

The Maritime & Coastguard Agency recognised this trend, and in February 2023, The High Speed Offshore Service Craft Code (HSOSC) was updated to enable up to 60 industrial personnel to be transported on High Speed Offshore Service Craft at one time, up from the previous legal limit of 24.

Sam Stout, Managing Director of CSO Shipbrokers, has seen first-hand the increased demand for higher PAX (short distance passenger) vessels. He explains, ‘This, along with a focus on emission reduction, is having a knock-on effect for existing vessels, with many of the older tonnage exiting the European market to emerging markets e.g., Taiwan, Japan, Ireland, and the Baltics, where wind farms are smaller and/or nearer to shore. We have also seen smaller units sold into the offshore survey market, where fewer passengers are onboard.’

Decarbonising the CTV market

Fuelled by a global drive to decarbonise maritime operations, governments, OEMs (Original Equipment Manufacturers) and industry bodies are pushing towards the development of greener CTVs.

Propelled forward by increased weighting given to lower emission solutions during the tendering phase for projects with the likes of Vestas, Ørsted, Vattenfall and GE, CTV owners and operators are focusing on future fuels and alternative propulsion to lower their carbon footprint.

Sam explains, ‘We’re seeing a focus on new-build vessels powered by either a mix of batteries and diesel or alternative fuels. However, a growing concern for the sector is a lack of clarity on which future fuels should be favoured, and whether the financial impact of opting for greener fuels is an investment industry leaders are willing to commit to. Without financial commitments from wind farm owners/operators, the financial burden of research and development into greener vessels sits with the vessel owners, a cost which for some, is not feasible without long term contracts in place for the vessels when operational.’

Hybrids combine diesel and electric power, while electric CTVs are powered exclusively with electricity. An example of hybrid CTVs include RMD’s Rockabill 27m and 32m which is designed to be powered by modular battery systems in series configuration, and is methanol-ready. They are able to produce significantly lower emissions and offer lower operating costs due to reduced fuel consumption.

CSO Shipbrokers projects that new builds for the North Sea will include 16 conventional CTVs and 15 hybrids in 2023. The company maintains the same projection for 2024.

CTV availability

The CTV market has seen some unpredictability over the last few years due to global and local economic influences.

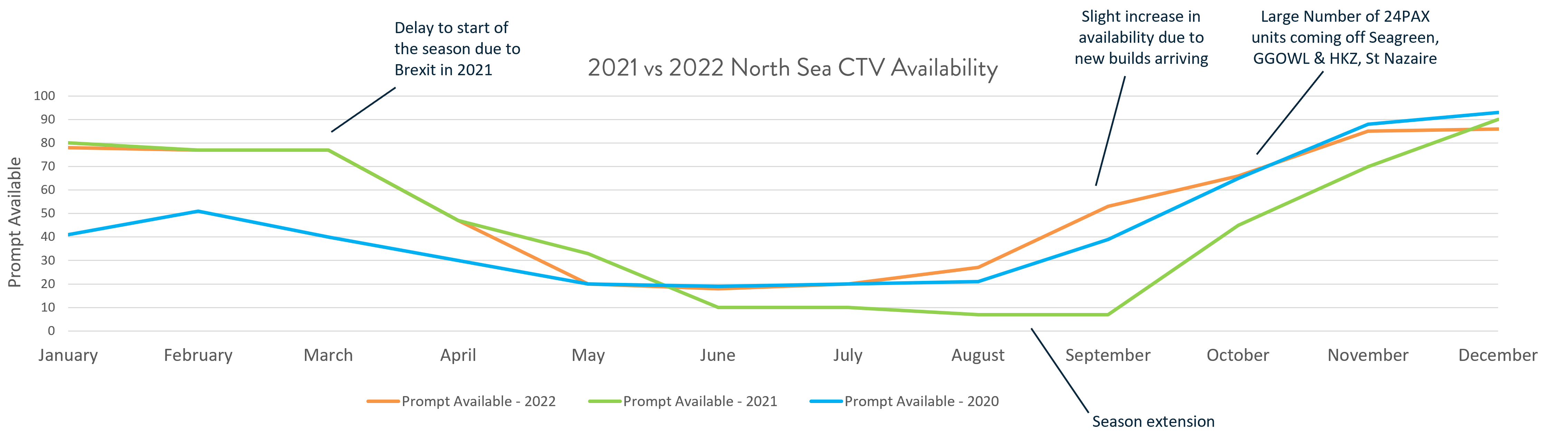

According to CSO Shipbrokers, the North Sea CTV market, as an example, saw a dip in prompt availability in March 2021. The delayed start to the season, with a March start in 2021 compared to February start in 2020, could be attributed to the uncertainty around Brexit. The declining availability continued until June, where there was a levelling off with low availability and a season extension due to the late start, which resulted in availability picking up again in Q4 of 2021.

Sam explains, ‘Significant factors affecting availability in 2021 included limited crew in the UK due to demand for workers in Europe, Brexit complications, and the reduction in availability due to older vessels exiting the market.’

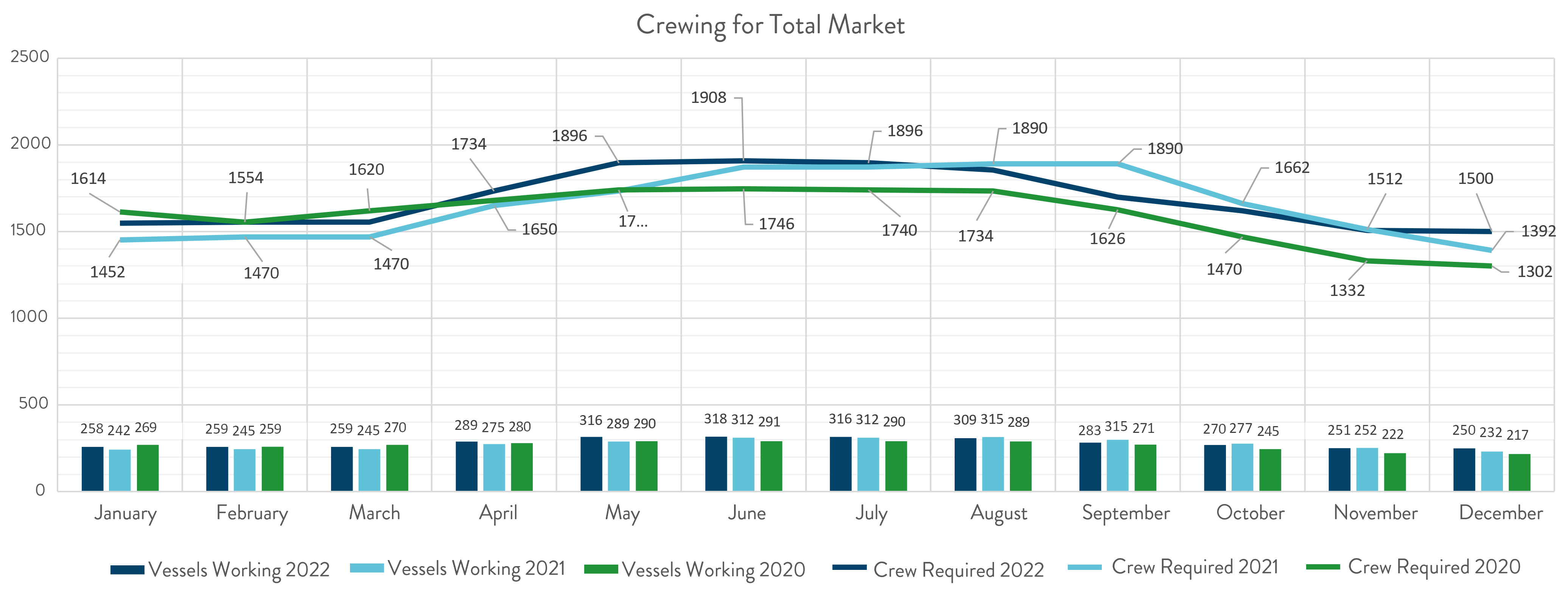

As shown in the graph, 2022 saw a similar level of vessel availability to that of 2021, however September’s availability was boosted by new build vessels entering the market, swiftly followed by a number of 24PAX units completing campaigns at Seagreen, Greater Gabbard, Hollandse Kust Zuid, and St Nazaire Wind Farms.

Since 2016, clients have relied on CSO Shipbrokers’s market intelligence and vessel market reports. The company’s extensive data was central to the conversation throughout CSO Shipbrokers’s ‘CTV Day’ event, which took place on 9 March 2023, in collaboration with Stephenson Harwood.

At the event, CTV specialist, Tom Nugent, Shipbroker at CSO Shipbrokers, made a series of predictions following thorough analysis of market trends. Tom explains, ‘We expect a slight uptick in availability for 24PAX vessels in Summer 2023 as we see an increase in the total units available between July and August due to new build deliveries.

‘We also anticipate the 20-25m LOA CTVs will have a similar level of availability to 2022. Whereas, the 15-20m LOA CTVs will have a similar trend as seen in 2022 with a lower level of availability due to older tonnage being divested.’

CTV day rates

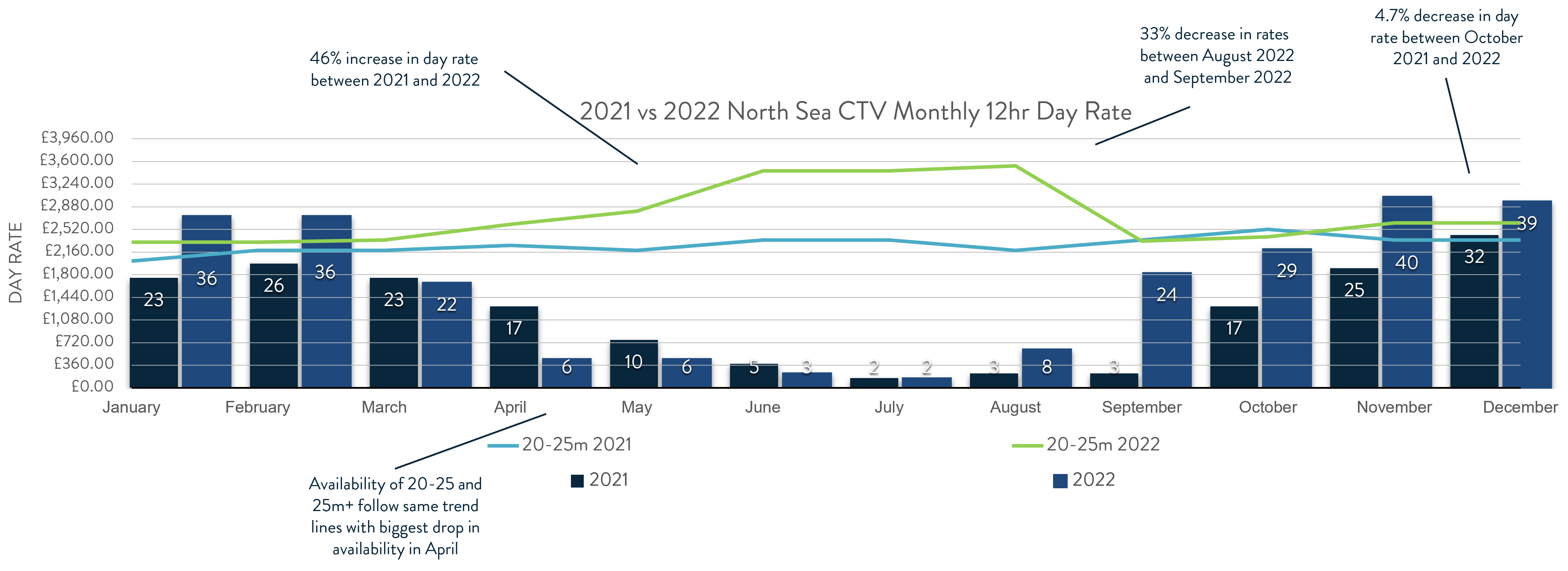

Day rates for 25m+ CTVs showed a 25% increase in the first months of 2022 compared to the same period in 2021.

However, by the latter months of 2022, day rates fell to 12.1% lower than in 2021.

The changes in the 20-25m CTV segment were starker, as there was a 46% increase in day rates in May 2022 compared to the same month in 2021. However, by October, a more stable 4.7% increase was seen in 2022 compared to 2021’s figures.

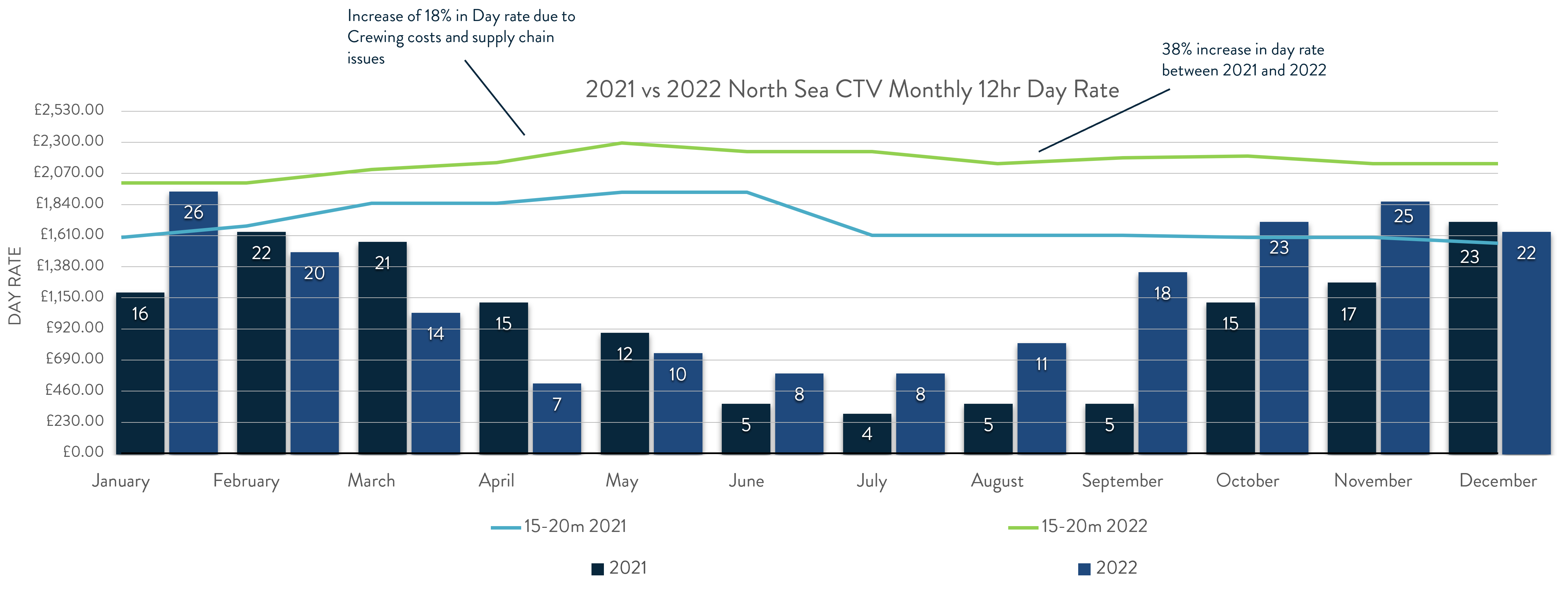

In the 15-20m segment, there was an 18% increase in day rates in April 2022 compared to 2021, which CSO Shipbrokers attributes to crewing costs and supply chain issues. However, unlike the other segments, the day rates increased toward the end of 2022 compared to 2021, recording a 38% rise.

Tom continues, ‘Following consultation with vessel owners/operators and charterers in 2023, we’re anticipating a 13-20% increase in day rates for 15-20m LOA and an 11-15% increase in day rates for 20-25m LOA vessels compared to 2022. We expect the standout increase to be with 25m+ LOA vessels, which we calculate will see an 18-22% increase in day rates for 2023 compared to the year before.

‘For the sale and purchase CTV market, we predict an increase in cost for 15-20m vessels and a number of new build orders for this year, which we will continue to provide updates on in our regular reports.’

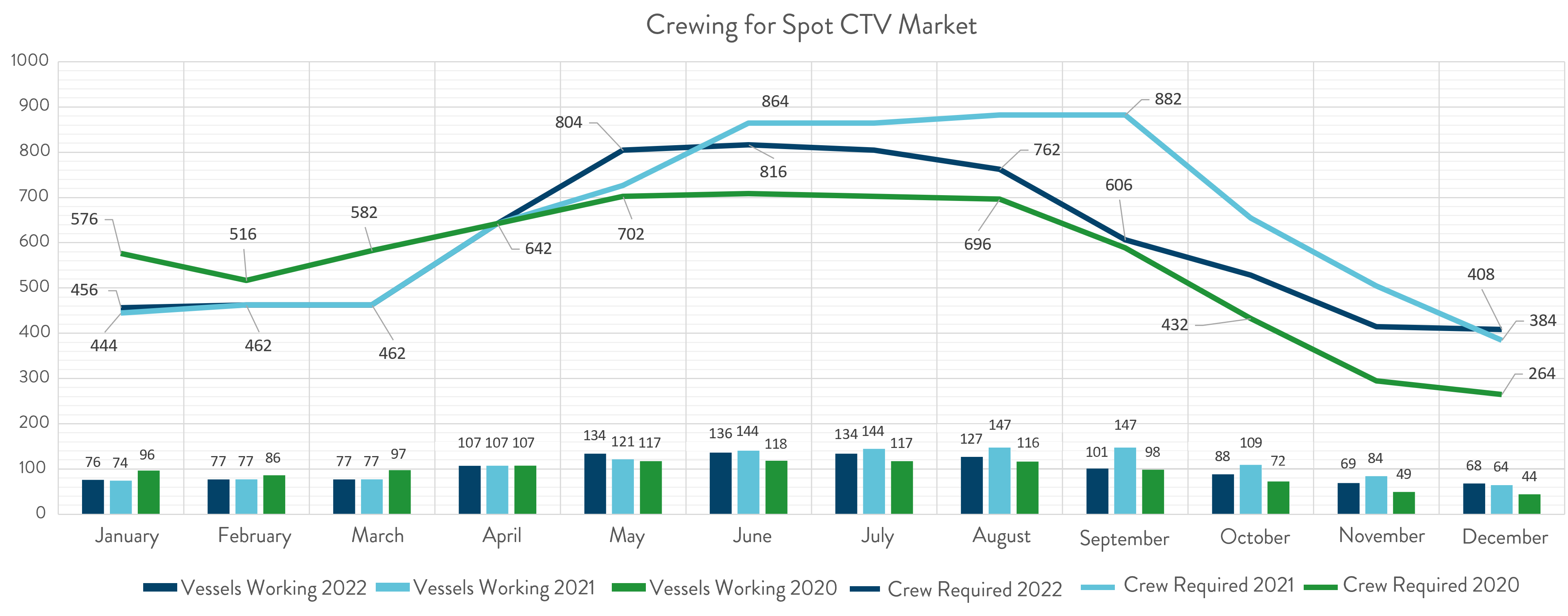

Crewing the CTV market

On 30 April 2023, the Offshore Wind Workers’ Visa Concession (the Concession) came to an end. Introduced in 2017, the scheme, permitted nationals from the non-European Economic Area (EEA), with necessary skills in the offshore wind industry, to enter the UK’s territories and work for a limited period.

Now the Concession has ended, what does this mean for CTV crew? A foreign national seaman under contract to join a vessel operating wholly or mainly within UK waters, i.e., inside 12nm zone, requires permission to work. For many, the skilled worker route is the best option for obtaining the right to work in UK waters, however this route has mandatory criteria including a minimum salary and qualifications, which may restrict some applicants.

It’s not only the Concession which has impacted crew availability in the UK.

The implementation of IR35, the UK government’s anti-avoidance tax legislation, has almost impacted the number of seaman available for work in the UK.

Sam explains, ‘We see the retention of the crew as one of the biggest hurdles for the CTV market to overcome. We work closely with our clients and our sister company, Offshore Operations, to ensure that our clients have the most suitable vessel for their requirements, manned by experienced and qualified crew.’

Conclusion

The CTV market plays a critical role in the offshore wind energy industry, and its importance is expected to increase as the industry continues to grow.

Despite the challenges facing the market, several opportunities for growth exist, including the expansion of offshore wind projects globally, advancements in CTV technology, and the growth of supporting services and infrastructure for offshore wind.

To navigate the market successfully, companies must implement strategies that prioritise safety, collaboration, innovation, and the development of skilled crew members.

Working with a trusted and well-connected brokerage firm means you will have access to unrivalled expertise, advice, and support when it comes to chartering or sale and purchase of CTVs.

Further information regarding manning and offshore worker support can be obtained through Offshore Operations at [email protected]

This article was originally published in PES Wind Issue 2 2023.